Hey curious minds, welcome to the economic rollercoaster where governments play financial chess to keep things in check! Have you ever heard of that financial wizardry called Contractionary Monetary Policy? Well, buckle up because today, we're breaking it down into bite-sized bits. Think of it as the government's way of saying, "Hold up, economy, let's not get too hot and bothered."

So, grab a seat as we demystify this financial brake system, explore the tools in its toolkit, and even throw in some real-world examples for good measure. Ready to navigate the twists and turns of economic stability? Let's dive in!

What is Contractionary Monetary Policy?

So, what's the deal with Contractionary Monetary Policy? Simply put, it's like the financial brakes governments use to slow down an overheated economy. When things get too spicy, with inflation shooting up like a rocket, central banks step in to cool things off. How? By making money a bit harder to get.

Now, don't go thinking it's a cruel joke. This policy helps maintain economic stability, keeping inflation in check and ensuring a smooth financial ride for everyone.

What are the Tools used in Contractionary Monetary Policy?

Now, let's dive into the toolkit of Contractionary Monetary Policy, where central banks wield their financial instruments to maintain a balanced economic dance.

Interest Rates - The Maestro of the Orchestra

Picture interest rates as the grand conductor of the economic orchestra. When central banks decide to raise interest rates, it's like turning up the tempo of borrowing costs. Think about it like your favorite video game suddenly doubling in price – you'd probably hesitate before making that purchase, right?

Well, the same principle applies to loans and mortgages. When interest rates climb, the cost of borrowing rises, and people and businesses might hit the brakes on spending and investment. It's a powerful tool to cool down an overheated economy.

Reserve Requirements - Holding Tight to the Purse Strings

Now, imagine the government sending a memo to banks saying, "Hold on to a bit more cash, won't you?" That's essentially what happens when reserve requirements are increased. Banks are required to stash away a larger chunk of their deposits, leaving them with less money to lend out.

It's like putting a bit of a financial leash on banks, curbing their ability to pump too much money into the economy. This, in turn, puts the brakes on spending and lending, helping to rein in inflation.

Open Market Operations - Buying and Selling on the Economic Playground

Open Market Operations might sound like financial magic, but it's simpler than you think. It's like the central bank's version of buying and selling goodies on the economic playground. When central banks buy government securities, they inject money into the system, making it easier for people and businesses to access funds.

On the flip side, when they sell securities, they're pulling money out, making it a bit more challenging to get cash. It's a delicate balance, like adjusting the taps on a water fountain to control the flow. This tool allows central banks to fine-tune the money supply, influencing interest rates and overall economic activity.

Forward Guidance - A Sneak Peek into the Crystal Ball

Imagine the central bank as your financial guru, providing hints about the future. This is where Forward Guidance comes into play. By signaling their intentions on interest rates and policies, central banks guide economic players on what's coming down the financial pipeline.

It's like a heads-up before a plot twist in a movie – you adjust your expectations and decisions accordingly. If the central bank hints at future interest rate hikes, businesses, and individuals might rethink their borrowing and spending plans. It's a subtle yet influential tool in shaping economic behavior.

So, in a nutshell, Contractionary Monetary Policy isn't just about pulling levers; it's a strategic deployment of these tools, each playing a crucial role in orchestrating a harmonious economic symphony.

Real-world Examples

Let's move beyond the textbook and into the real world. Ever heard about the US Federal Reserve tightening its monetary policy? That's a classic Contractionary move.

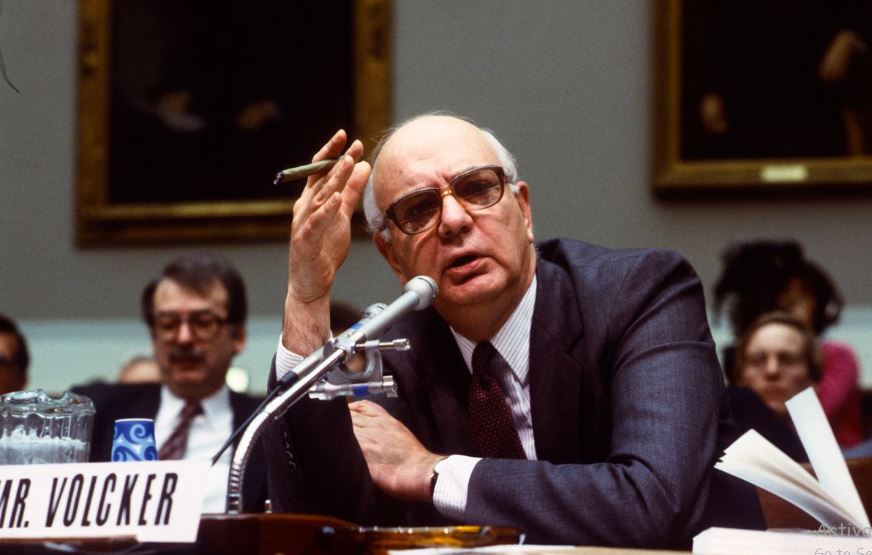

Volcker's War on Inflation (1980-1982)

Paul Volcker, the Federal Reserve Chair at the time, fought against soaring inflation. He cranked up interest rates to double digits, bringing inflation down but causing a temporary recession. It's like taking bitter medicine for a long-term health benefit.

European Central Bank (ECB) during Eurozone Crisis (2010-2012)

Facing economic turmoil, the ECB hiked interest rates to tackle inflation. Unfortunately, this move intensified the crisis, highlighting the delicate dance central banks must perform in challenging times.

People's Bank of China (PBOC) Actions (2011)

China, worried about rising prices, increased reserve requirements for banks. The result? A slowdown in lending and economic activity showcases how reserve requirements can be a powerful tool.

Contractionary Policy vs. Expansionary Policy

Now, let's not forget about the yin to Contractionary's yang – Expansionary Monetary Policy. While Contractionary puts the brakes on a heated economy, Expansionary does the opposite, revving things up when the economic engine is sputtering.

In the Expansionary world, interest rates drop, reserve requirements loosen, and the central bank might even buy up securities like a shopping spree. The goal? To boost spending, investment, and employment.

So, the next time your economy feels like a rollercoaster, know that central banks are playing a high-stakes game to keep the ride enjoyable for everyone.

Conclusion

Contractionary Monetary Policy is the unsung hero of economic stability. We've journeyed through its definition, peeked into its toolbox, and even took a stroll through history with some real-world examples. Remember, it's like financial medicine – a bit bitter at first, but it keeps the economic health in check.

As we wrap up, keep in mind that Contractionary isn't alone in this economic adventure. Its counterpart, the Expansionary Monetary Policy, is always ready to step in when the economy needs a boost. It's a delicate dance but one that keeps our financial world spinning.