Tax-loss harvesting is an effective investment strategy that allows investors to reduce their taxable income while increasing their potential returns. A portfolio's losers can be liquidated to reduce taxable income or capital gains. Those with a high net worth, who may be subject to hefty tax bills due to capital gains, may benefit greatly from this. Tax-loss harvesting is useful because it allows investors to pay less in taxes. Investors can keep more of their profit from investments by lowering their taxable income by using losses to offset gains. This can have a significant impact on an investor's long-term wealth accumulation, as taxes can have a significant impact on investment returns over time. Rebalancing and optimizing investments for long-term goals are two additional ways in which tax-loss harvesting can aid investors.

How Tax-Loss Harvesting Works

Portfolio losses can be used to reduce taxable income by engaging in tax-loss harvesting. An investor can reduce their taxable income by taking advantage of the tax loss carryforward rule when selling a losing investment. If an investor has realized gains of $10,000 from the sale of one stock and losses of $8,000 from the sale of another stock, the investor can reduce their taxable income by selling the stock with the loss. The process can offset short-term and long-term gains and be carried forward to future years if necessary. Tax-loss harvesting is a strategy that can help investors lower their effective tax rates and boost their long-term investment returns.

Advantages of Tax-Loss Harvesting

Minimizing Taxes

Tax-loss harvesting has the potential to help investors save money by lowering their yearly tax bill. Investors could keep more of their profit from investments by lowering their taxable income by utilizing losses to offset gains. This can have a significant impact on an investor's long-term wealth accumulation, as taxes can have a significant impact on investment returns over time.

Portfolio Optimization

Tax loss harvesting is another tool that can aid in portfolio optimization. Investors can reallocate their capital to more promising opportunities by selling underperforming investments. This can improve their portfolio performance and help them achieve their financial objectives.

Rebalancing

Portfolio rebalancing is another way in which tax loss harvesting can aid investors. By selling losing investments and using the proceeds to purchase new investments, investors can ensure that their portfolios remain balanced and aligned with their long-term goals.

Flexibility

Tax-loss harvesting is a flexible strategy used in various investment scenarios. Investors can utilize it to reduce their taxable income in the current year or store it away for future years.

Hazards of Tax-Loss Harvesting

Market Risk

One of the main risks of tax-loss harvesting is market risk. If an investor sells a losing investment and the market recovers, they may miss out on potential gains. Another way an investor could lose money is if they sell an asset and then buy another one that underperforms.

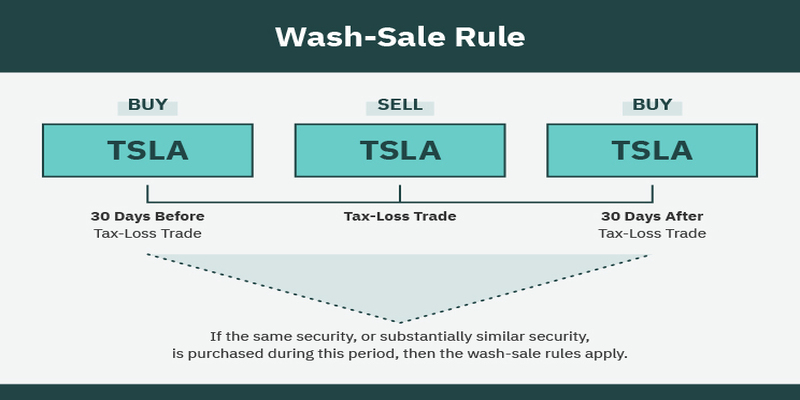

Wash Sale Rule

Another risk of tax-loss harvesting is the wash sale rule. Under the wash sale rule, investors cannot reinvest the proceeds from a loss-making sale into the same or similar security within 30 days. If traders break this rule, they cannot utilize the loss to reduce their profit.

Transaction Costs

Tax-loss harvesting can incur transaction costs, such as brokerage fees and taxes. These costs can reduce the overall benefits of the strategy.

Conclusion

Tax-loss harvesting is a powerful investment strategy that can benefit investors by minimizing their tax liabilities and maximizing their investment returns. By selling losing investments to offset gains in other investments, investors can reduce their overall tax burden and keep more investment returns. Tax-loss harvesting can also help investors rebalance their portfolios and optimize their investments for their long-term goals. While there are risks associated with the strategy, such as market risk, the benefits can outweigh the risks for investors looking to minimize their tax liabilities and maximize their investment returns over the long term. Tax-loss harvesting is a flexible strategy used in various investment scenarios and carried forward to future years, allowing investors to maximize their tax benefits. Tax-loss harvesting can be a valuable tool for investors looking to achieve their financial objectives while minimizing their tax liabilities.